Retain Loyal Medical Staff

"If you stay with us, you’ll retire with a guaranteed $6,000/month for life."

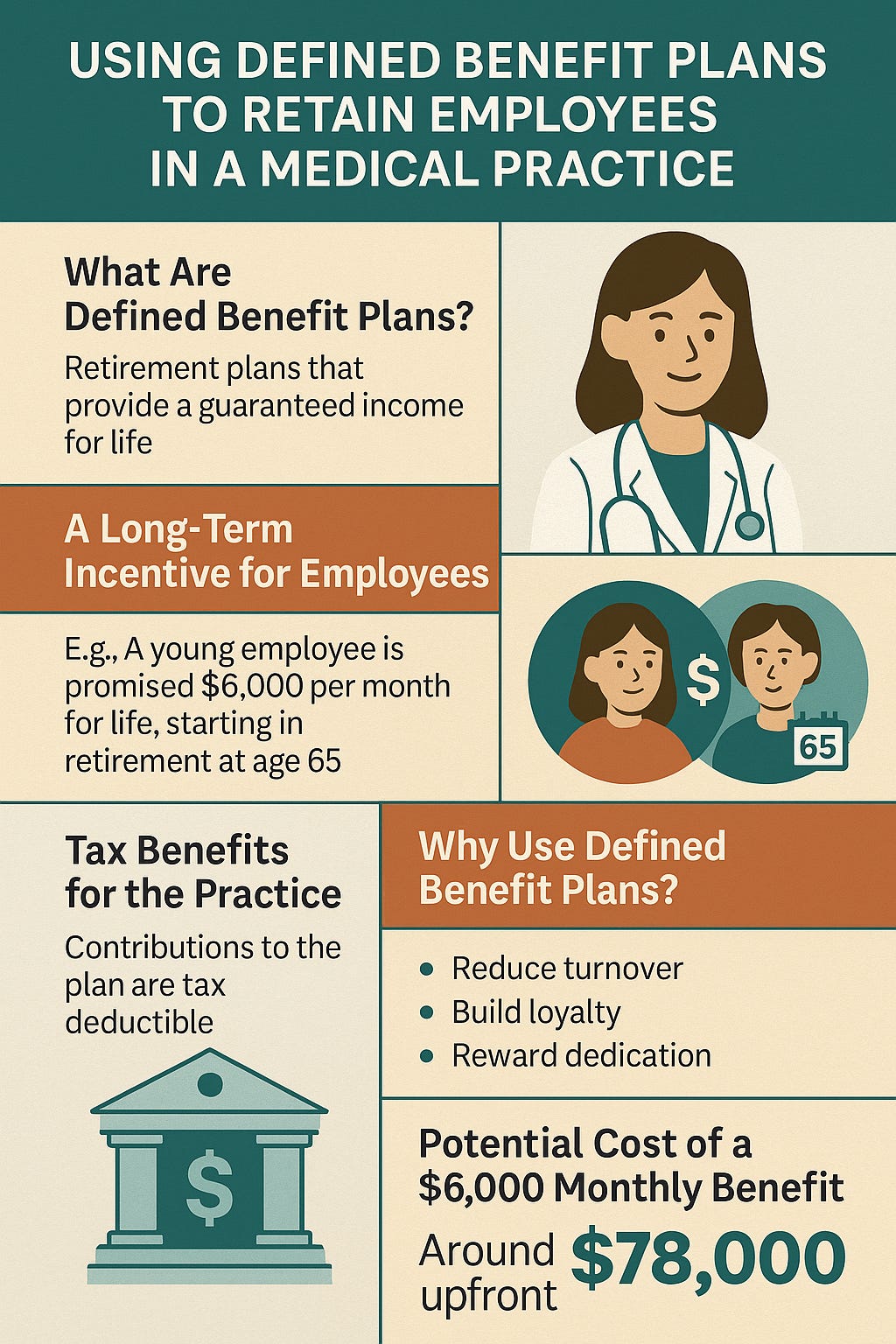

For any employee—especially in today’s high-turnover healthcare environment—that’s a powerful promise. And for doctors looking to build a high-retention, mission-driven team, it’s not just aspirational. It’s attainable through a smart and underutilized tool: the Defined Benefit (DB) pension plan.

“Pensions make loyalty tangible—employees see a future with you, not just a paycheck.”

— Maria Chen, Senior Analyst, Defined Benefits

In this article, we’ll explain how DB plans work, why they offer unique value for small medical practices, and how a simple benefit structure can translate into long-term loyalty and lower turnover costs. Whether you run a dental practice, orthopedic clinic, or primary care group, understanding the math and strategy behind DB pensions could dramatically transform how you recruit, retain, and reward your staff.

The Challenge: Turnover in Healthcare Is Expensive and Disruptive

The healthcare sector is experiencing historically high turnover. Administrative staff, medical assistants, and even nurses are leaving at higher-than-normal rates due to burnout, compensation dissatisfaction, and a lack of long-term security. For private practice owners, every departure costs thousands in lost productivity, hiring, and retraining—not to mention the strain on patient experience.

While higher wages may offer temporary relief, they don't necessarily instill long-term commitment. What’s often missing is a sense of future stability and clear rewards for loyalty.

The Opportunity: Defined Benefit Plans Build Security and Signal Commitment

Defined Benefit plans are traditional pensions that offer employees a guaranteed monthly benefit at retirement, typically based on salary and years of service. While commonly associated with large institutions or government jobs, these plans are fully accessible to small businesses, including medical practices—even those with just one owner-employee.

Here’s the unique angle: instead of throwing more money at raises or short-term bonuses, you can contribute to a DB plan tax-deductibly, build retirement wealth for employees, and send a powerful message:

“We invest in your future, not just your present.”

A Real Example: Creating a $6,000/Month Retirement Benefit

Let’s say you want to offer a compelling benefit to a younger employee—maybe a medical assistant or receptionist who’s shown promise. You want to incentivize them to stay with your practice for the long haul, and you’re wondering what it would cost to secure them a meaningful retirement benefit.

Suppose you promise them a $6,000 monthly benefit starting at age 65, guaranteed for life. They’re 18 years old now.

Using conservative actuarial assumptions (5% discount rate, no cost-of-living adjustments, and a 20-year post-retirement life expectancy), the present value of that promise today is just $78,260.

That means you could set aside less than $80,000 today to fund a lifetime benefit worth over $1.4 million in total payouts by retirement.

Not only is this contribution tax-deductible for your business, but it’s also more emotionally powerful than a standard 401(k) match or annual bonus. It tells the employee:

“If you stay and grow with us, we’re going to take care of you when you retire.”

Why This Works: The Psychology of Deferred Gratification

Defined Benefit plans aren’t just financially effective—they’re psychologically smart.

Unlike bonuses or annual raises, a DB plan rewards long-term service. Employees understand they won’t get the full benefit if they leave early, which aligns their interests with yours. That creates “golden handcuffs”—a powerful incentive to stay, grow, and contribute at a high level over time.

Moreover, many employees—especially younger ones—don’t know how to plan for retirement. Offering a defined benefit shows that you’ve thought about their future, even when they haven’t. That creates trust, which in turn builds loyalty.

Tax Benefits and Funding Flexibility for the Doctor

Defined Benefit plans also deliver exceptional value to practice owners.

If you are both the employer and an employee of your practice, you can design the plan to benefit yourself and your staff, with large annual contribution limits often exceeding what’s allowed in a 401(k) or SEP-IRA.

For example, doctors in their 50s can sometimes contribute $150,000 to $300,000 per year, fully tax-deductible, depending on income, age, and years of service. And those funds grow tax-deferred until retirement.

The plan is customizable too—you decide which employees are eligible, what the benefit formula is, and how it integrates with other retirement plans.

“For under $80K, you can promise a million-dollar retirement. That’s smart business.”

— David Morales, Plan Strategist, Defined Benefits

Coordinating with 401(k) or Cash Balance Plans

Many practices already offer a 401(k) or SIMPLE IRA, which is great. But a DB plan can stack on top of those, offering higher total benefits and covering different time horizons.

Better yet, you can design a combined retirement plan strategy, using a 401(k) with a safe harbor match plus a DB or cash balance plan, to optimize both tax savings and staff retention.

For example:

401(k) match handles short-term incentives

DB plan handles long-term retention and retirement security

This two-layer approach creates a more complete incentive structure—meeting employees where they are now, while guiding them toward a future vision.

What It Looks Like to the Employee

Let’s take a moment to imagine this from the employee’s perspective.

You're 22 years old, two years into a front desk job at a respected dermatology clinic. You like the team, but wonder if you should go back to school or explore other job options.

Then your employer tells you:

“If you stay with us, and we keep building your pension plan, you’ll retire with $6,000/month guaranteed for life. You won’t have to worry about outliving your money.”

That’s not just a job. That’s a career with security. And for many employees—especially those from underrepresented backgrounds or communities without access to intergenerational wealth—that kind of promise is life-changing.

Final-Year Payouts and Flexibility

If you decide to terminate the plan later or a staff member leaves, they can roll their vested benefit into an IRA or take a lump sum, depending on plan design. You’re not locked in forever—but you are rewarding tenure meaningfully.

It’s worth noting that IRS rules require filing Form 5500-EZ if plan assets exceed $250,000 or if it’s the final year of the plan. But for many small practices, the administrative burden is low—especially if you work with a third-party administrator (TPA) or actuary to manage it.

Is This Right for Your Practice?

A DB plan isn’t for every business. It works best when:

You have stable cash flow

You want to maximize tax-deductible retirement contributions

You care about employee retention

You want to reward yourself and/or long-serving employees meaningfully

If your practice is growing and your staff are core to that growth, a DB plan turns that growth into shared wealth—without giving up equity or raising salaries endlessly.

How to Get Started

Talk to a TPA or pension consultant to run a custom plan design and cost estimate.

Identify key employees you want to retain long term.

Integrate the DB plan with your existing retirement offerings.

Communicate the benefit clearly to your team—it’s not just what you offer, it’s how you explain it.

We recommend starting the conversation well before year-end so you can fund the plan for this tax year if desired.

Offering a pension may sound old-fashioned, but in today’s world of economic uncertainty and job-hopping, stability is a luxury benefit. As a doctor, you can offer your staff something few employers do: a guaranteed income for life.

With just a modest upfront investment, you can make a promise that binds employees to your practice with more than just a paycheck—with purpose, appreciation, and shared future success.

In an era where everyone’s chasing instant gratification, a Defined Benefit plan is a powerful reminder that long-term relationships still matter—and that your practice is here to stay.