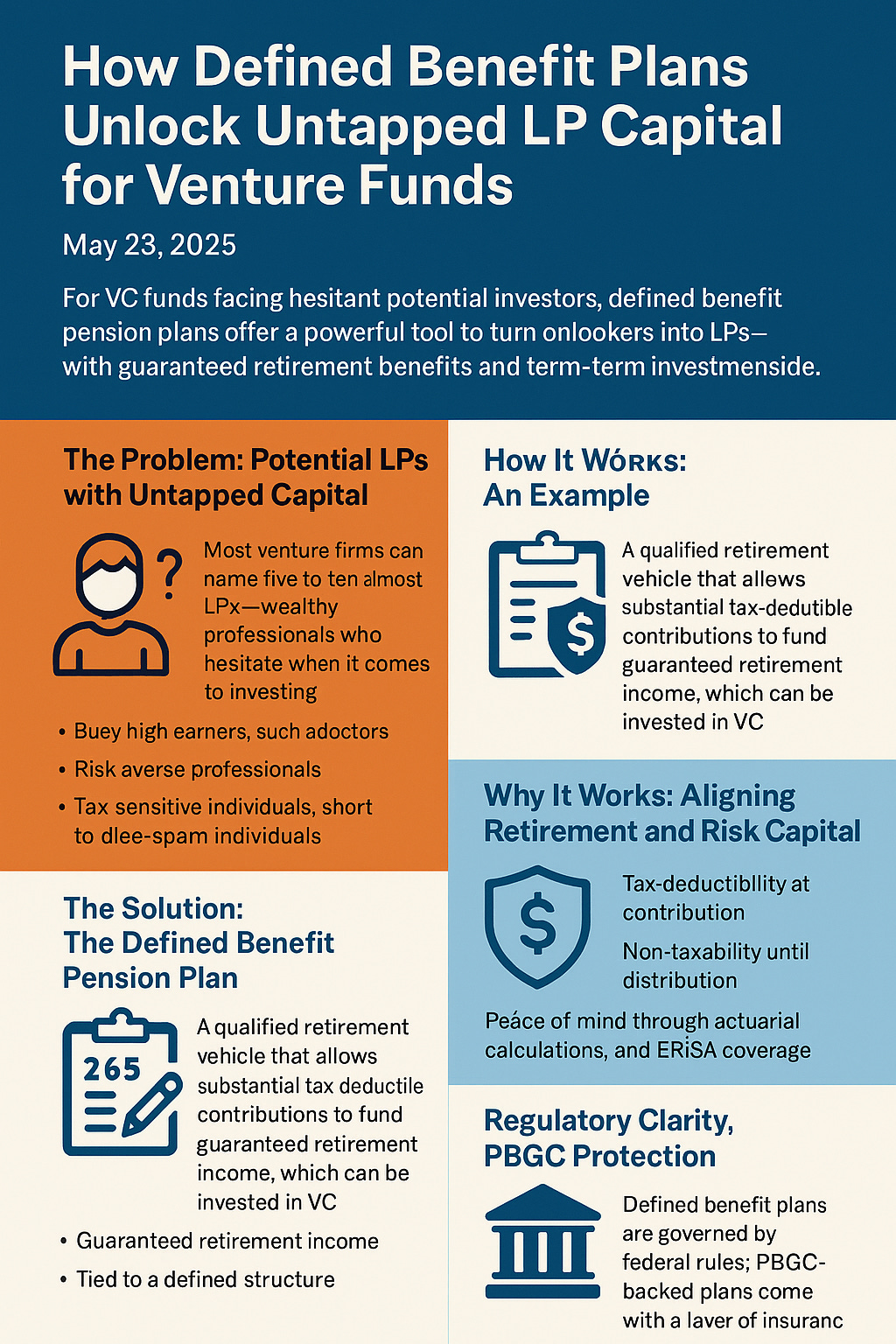

How Defined Benefit Plans Unlock Untapped LP Capital for Venture Funds

For VC funds facing hesitant potential investors, Defined Benefit pension plans offer a powerful tool to turn onlookers into LPs—with guaranteed retirement benefits and long-term investment upside.

Venture capital is a game of relationships and timing. Every general partner has a list—dozens, sometimes hundreds—of well-networked professionals, high-income earners, or successful entrepreneurs who’ve taken a meeting, expressed interest, but never written a check. They're often too cautious, too illiquid, or too uncertain about venture's risk profile. But what if you could reframe that investment not as a discretionary bet, but as a qualified, tax-deductible retirement strategy?

That’s the promise of working with Defined Benefits, a firm specializing in setting up defined benefit pension plans that transform high-earning individuals from interested bystanders into active limited partners—by aligning venture commitments with tax strategy, retirement planning, and long-term wealth preservation.

The Problem: Potential LPs with Untapped Capital

Most venture firms can name five to ten “almost LPs”—wealthy professionals who admire the strategy, believe in the thesis, and even attend dinners or demo days, but hesitate when the wire instructions arrive. These individuals often fall into one of three categories:

Busy high earners, such as doctors, dentists, or small business owners, who don’t view themselves as “investors.”

Risk-averse professionals, who may not have exposure to private markets and fear capital loss.

Tax-sensitive individuals, who struggle to justify locking up after-tax capital in illiquid, long-term venture vehicles.

The common thread? These people are not short on income—they’re short on structure.

The Solution: The Defined Benefit Pension Plan

A Defined Benefit (DB) pension plan is a qualified retirement vehicle under ERISA and the Internal Revenue Code that allows business owners and self-employed individuals to contribute substantial sums—sometimes $200,000–$300,000 per year—into a tax-deferred vehicle designed to provide guaranteed retirement income.

Unlike 401(k)s or IRAs, which have modest contribution limits, DB plans are tailored to fund a specific retirement benefit based on age, income, and years until retirement. Contributions are tax-deductible to the business, tax-deferred for the individual, and can be invested into a broad range of vehicles—including venture capital funds.

“It’s the ultimate unlock for venture GPs sitting on a list of ‘warm leads,’” says Robert Mowry, partner at Del Mar Medical Devices. “When you help someone set up a DB plan, you’re not asking them to take on new risk—you’re giving them a tax-advantaged way to fulfill a retirement promise. Venture becomes the growth engine, not the gamble.”

How It Works: An Example

Imagine a successful oral surgeon, age 52, who runs her own practice and earns $750,000 annually. She wants to retire in 10 years but has already maxed out her 401(k) and is unsure where to put additional savings. She’s interested in VC—maybe a fund led by a college classmate—but hesitates at writing a $100K check from her personal account.

Here’s how a DB plan changes the conversation:

Plan Design: Defined Benefits consults with the surgeon to create a pension plan targeting $2.6M in retirement income.

Tax Deduction: The plan allows her to contribute $265,000/year from her business pre-tax.

Investment Strategy: The plan allocates 60% to conservative income-generating assets, but 40%—or $106,000—can go into long-term growth strategies like a venture fund.

Guaranteed Outcome: Even if venture returns take time to mature, the defined structure of the plan ensures her retirement is on track.

Now, the VC fund has a new LP—fully aligned, tax-optimized, and planning to contribute again next year.

Why It Works: Aligning Retirement and Risk Capital

The genius of using a defined benefit structure is that it bridges two seemingly contradictory mindsets: the conservative long-term planner and the forward-looking investor.

For many high earners, venture feels too speculative. But as part of a DB plan, VC allocation is:

Tax-deductible at contribution, reducing this year’s tax bill.

Non-taxable until distribution, deferring gains for years or decades.

Housed within a guaranteed framework, where actuarial calculations and ERISA coverage add peace of mind.

“Too many professionals let their cash sit idle because they don’t want to lose it,” says Mowry. “But when you can show them that the IRS is funding nearly half of their VC investment through deductions—and that they’re building a guaranteed pension in the process—the conversation shifts completely.”

Regulatory Clarity, PBGC Protection

Defined benefit plans are governed by strict federal rules, but that structure is part of what gives investors comfort. Plans are designed by enrolled actuaries, often paired with third-party administrators (TPAs), and filed annually with the IRS.

Moreover, if a DB plan is structured as a single-employer or multi-employer plan, it can be covered by the Pension Benefit Guaranty Corporation (PBGC)—a federal agency that ensures plan participants receive benefits even if the sponsor company fails.

This matters for venture funds working with self-employed LPs or business owners. PBGC-backed plans carry an additional layer of federal insurance, which can be a persuasive factor for the risk-averse.

Venture as the Alpha Allocation

Defined benefit plans don’t allow reckless investing—but they do allow prudent diversification, especially for plans with long time horizons. Most DB plans allocate a portion of assets to growth-oriented investments, including private equity, real estate, and VC.

For GPs, this means:

More repeatability: DB sponsors often commit again annually, unlike typical LPs who invest once per fund.

More alignment: Contributions are pre-planned and predictable, matching the fund’s capital call structure.

More stickiness: Pension participants are long-term thinkers—there for the full lifecycle.

Over time, a venture fund could develop an entire class of LPs who contribute year after year through their DB plans, making it easier to scale Fund II and beyond.

Fund Strategy: How GPs Can Activate DB Opportunities

To capitalize on this model, venture funds should take a proactive approach. Here are three steps:

Identify the right prospects: Prioritize warm leads with high income, business ownership, and interest in tax optimization.

Partner with DB professionals: Work with firms like Defined Benefits to offer a white-glove setup service.

Educate through content: Host webinars, send targeted memos, or invite prospective LPs to info sessions on “VC Inside a Pension Plan.”

Some funds have even co-sponsored retirement planning workshops with TPAs, wealth advisors, and pension actuaries, turning a cold outreach into a collaborative onboarding event.

Objection Handling: What if My Prospects Already Have a 401(k)?

That’s fine. Defined benefit plans stack with 401(k)s. In fact, DB plans are most powerful when layered on top of existing retirement infrastructure. The key difference is scale: while a 401(k) maxes out around $66,000/year with catch-up contributions, DB plans can allow three to five times that amount.

If a client already contributes to a 401(k), they can often roll over both structures into a tax-deferred account at retirement, consolidating assets without triggering penalties.

Final Word

For venture firms frustrated by inertia from otherwise promising prospects, Defined Benefit plans offer a sophisticated, compliant, and aligned way to turn income into investment. They also reframe your value as a GP—not just as a deal picker, but as a catalyst for long-term wealth creation.

By partnering with retirement specialists and offering a higher purpose than just returns—financial freedom through structured investing—you gain a new superpower: the ability to turn "no" into "not yet," and "not yet" into a committed LP with a 10-year plan.

Interested in offering a DB-based LP structure to your prospects?

Start with a conversation. As Mowry puts it:

“This is about building systems, not just portfolios. And when LPs have a system that works, they don’t just invest once. They invest for the next 20 years.”